Difference between revisions of "Payroll: ACA Reporting"

| (6 intermediate revisions by 2 users not shown) | |||

| Line 4: | Line 4: | ||

<span style="color:#FFFFFF; background:#FF0000; font-size:30">Preliminary Notes for 2020 ---- Wait for notification before processing</span> | <span style="color:#FFFFFF; background:#FF0000; font-size:30">Preliminary Notes for 2020 ---- Wait for notification before processing</span> | ||

--> | --> | ||

| + | <span style="color:#FFFFFF; background:#FF0000; font-size:30">2024 ACA filing requires Keystone 4.7.6 or higher ---- files may be uploaded to the web portal after 12/12/2024</span> | ||

<span style="color:#FFFFFF; background:#FF0000; font-size:50">ACA Fines for Late Filing are Severe -- Do Not Procrastinate!</span> | <span style="color:#FFFFFF; background:#FF0000; font-size:50">ACA Fines for Late Filing are Severe -- Do Not Procrastinate!</span> | ||

| + | <!-- | ||

<b>Keystone supports 2020 State (CA, DC, NJ, RI) and Federal E-Filing of 1094-C/1095-C ACA forms using our 3rd party provider.</b> | <b>Keystone supports 2020 State (CA, DC, NJ, RI) and Federal E-Filing of 1094-C/1095-C ACA forms using our 3rd party provider.</b> | ||

===Starting 2020=== | ===Starting 2020=== | ||

| + | --> | ||

<p> | <p> | ||

| Line 15: | Line 18: | ||

*When using the new Offer Codes (1L, 1M, 1N, 1O, 1P, 1Q) you MUST specify the following on the ACA tab in Employee Maintenance: | *When using the new Offer Codes (1L, 1M, 1N, 1O, 1P, 1Q) you MUST specify the following on the ACA tab in Employee Maintenance: | ||

**Employee Age | **Employee Age | ||

| − | ** | + | **Employee Zip Code |

</p> | </p> | ||

| − | <span style="color:#FFFFFF; background:#FF0000; font-size:50"> | + | <span style="color:#FFFFFF; background:#FF0000; font-size:50">2024 ACA 1094-C/1095-C filing requires Keystone version 4.7.6 or higher.</span> |

<!-- | <!-- | ||

--> | --> | ||

| − | Keystone | + | Keystone uses our third party vendor to print 1095-C forms and e-file 1094-C/1095-C information for both regular and self-insured employers. This page will provide assistance with entering the required ACA information into Keystone. It is your responsibility to gather this information and to assure that it is accurate. You should consult your accountant before filing ACA information. |

| Line 29: | Line 32: | ||

'''NOTE:''' This is part of the complete [[Payroll: Year End]] Process. | '''NOTE:''' This is part of the complete [[Payroll: Year End]] Process. | ||

| + | <!-- | ||

====Your 1095 Filing Options==== | ====Your 1095 Filing Options==== | ||

| Line 38: | Line 42: | ||

*Must purchase, print and distribute forms to employees | *Must purchase, print and distribute forms to employees | ||

*Must file paper forms with government agencies | *Must file paper forms with government agencies | ||

| − | | | + | ||} |

| − | + | --> | |

| + | |||

| + | |||

| + | ===Web Services E-File=== | ||

| + | Keystone will help you prepare and upload data to our online service partner. For a small per-employee fee have all 1095s printed and mailed to employees and E-Filed to government agencies. This option does '''not''' require registration with government agencies. <b>This is the only option for ACA 1095 Printing and E-File.</b> | ||

*No need to purchase, print and mail 1094 and 1095 forms | *No need to purchase, print and mail 1094 and 1095 forms | ||

*No registration with government required | *No registration with government required | ||

| Line 46: | Line 54: | ||

*Option for employer to re-print forms online | *Option for employer to re-print forms online | ||

*A per-form fee is charged for this service - see chart below | *A per-form fee is charged for this service - see chart below | ||

| − | |||

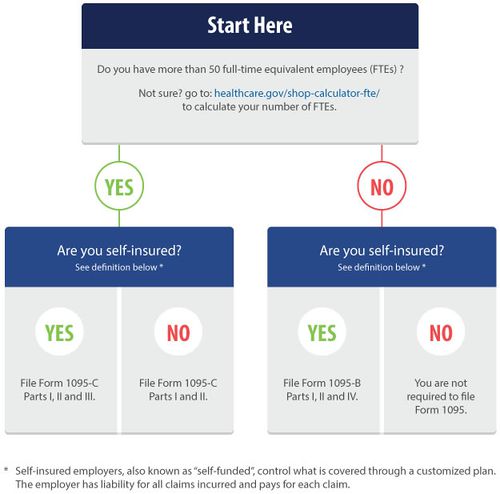

Use this chart to determine if you need to file 1095s. (See: https://www.healthcare.gov/shop-calculators-fte/) | Use this chart to determine if you need to file 1095s. (See: https://www.healthcare.gov/shop-calculators-fte/) | ||

[[File:ACA Decision Tree.jpg|500px]] | [[File:ACA Decision Tree.jpg|500px]] | ||

| + | |||

| + | <!-- | ||

=Paper Only 1095s= | =Paper Only 1095s= | ||

| Line 63: | Line 72: | ||

Keystone does not print 1094-C forms. You should prepare this form manually. | Keystone does not print 1094-C forms. You should prepare this form manually. | ||

| + | --> | ||

| + | |||

| + | =E-File 1095 Process= | ||

| + | <!-- | ||

| − | |||

'''Note:''' Keystone uses a Web Based E-Processing service that includes an option to handle all printing and mailing services. This new process eliminates the challenging process of registering with the IRS and offers several other advantages. There is a per employee cost for this new process. | '''Note:''' Keystone uses a Web Based E-Processing service that includes an option to handle all printing and mailing services. This new process eliminates the challenging process of registering with the IRS and offers several other advantages. There is a per employee cost for this new process. | ||

| + | --> | ||

==Prepare for E-File== | ==Prepare for E-File== | ||

| Line 89: | Line 102: | ||

Use this link to determine whether you must file 1095-C forms electronically | Use this link to determine whether you must file 1095-C forms electronically | ||

https://www.irs.gov/Affordable-Care-Act/Employers/Information-Reporting-by-Applicable-Large-Employers | https://www.irs.gov/Affordable-Care-Act/Employers/Information-Reporting-by-Applicable-Large-Employers | ||

| + | |||

| + | <!-- | ||

=About Web Services= | =About Web Services= | ||

Keystone supports electronic filing of year-end forms built right into our software. No more stuffing envelopes, no more printing! Electronically file W-2, 1095, 1094 (Affordable Care Act) forms, and more to the IRS/SSA or state in minutes! | Keystone supports electronic filing of year-end forms built right into our software. No more stuffing envelopes, no more printing! Electronically file W-2, 1095, 1094 (Affordable Care Act) forms, and more to the IRS/SSA or state in minutes! | ||

| + | --> | ||

==How it Works== | ==How it Works== | ||

| Line 101: | Line 117: | ||

*Finish processing following the online options. | *Finish processing following the online options. | ||

*E-File services let you preview and adjust data before filing. | *E-File services let you preview and adjust data before filing. | ||

| − | :When filing 1095s (and optionally W2s) you | + | :When filing 1095s (and optionally W2s) you choose the option E-File as well as Print and Mail Services. Keystone does not print 1095 forms. |

| − | |||

| − | |||

:With the Print and Mail services your 1095s are printed and mailed directly to employees. In addition an email is sent to each employee with an option to preview forms online. | :With the Print and Mail services your 1095s are printed and mailed directly to employees. In addition an email is sent to each employee with an option to preview forms online. | ||

*Verify that E-Filing has been accepted by the IRS. '''NOTE:''' 1095 filing is much more prone to rejection than W-2 filings. The most common issue is TIN (SSN) mismatches due to small errors with name spellings. | *Verify that E-Filing has been accepted by the IRS. '''NOTE:''' 1095 filing is much more prone to rejection than W-2 filings. The most common issue is TIN (SSN) mismatches due to small errors with name spellings. | ||

Latest revision as of 13:24, 5 December 2024

Contents

Introduction

2024 ACA filing requires Keystone 4.7.6 or higher ---- files may be uploaded to the web portal after 12/12/2024

ACA Fines for Late Filing are Severe -- Do Not Procrastinate!

- Each full-time employee for any calendar month MUST have a Plan Start Month specified on the ACA tab in Employee Maintenance. (Previously this field was optional, it is now required.)

- When using the new Offer Codes (1L, 1M, 1N, 1O, 1P, 1Q) you MUST specify the following on the ACA tab in Employee Maintenance:

- Employee Age

- Employee Zip Code

2024 ACA 1094-C/1095-C filing requires Keystone version 4.7.6 or higher.

Keystone uses our third party vendor to print 1095-C forms and e-file 1094-C/1095-C information for both regular and self-insured employers. This page will provide assistance with entering the required ACA information into Keystone. It is your responsibility to gather this information and to assure that it is accurate. You should consult your accountant before filing ACA information.

NOTE: This is part of the complete Payroll: Year End Process.

Web Services E-File

Keystone will help you prepare and upload data to our online service partner. For a small per-employee fee have all 1095s printed and mailed to employees and E-Filed to government agencies. This option does not require registration with government agencies. This is the only option for ACA 1095 Printing and E-File.

- No need to purchase, print and mail 1094 and 1095 forms

- No registration with government required

- Certified vendor reduces legal risks

- Option for employee to re-print via email link

- Option for employer to re-print forms online

- A per-form fee is charged for this service - see chart below

Use this chart to determine if you need to file 1095s. (See: https://www.healthcare.gov/shop-calculators-fte/)

E-File 1095 Process

Prepare for E-File

- In Keystone please verify that employee social security numbers and names are accurate. Your entire batch of 1095-C forms will be completely rejected if social security numbers and names cannot be validated by the IRS!

- Verify email addresses are accurate. While not required employees receive notification of forms via email and can optionally download a copy in addition to the mailed form.

- Update employee email addresses in Payroll: Employee File Maintenance. This gives employees direct access to forms online.

Preparing the Upload File

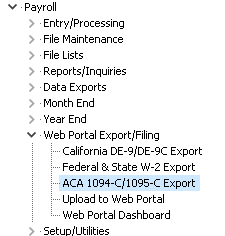

- Run ACA 1094-C/1095-C Export from the Web Portal Export/Filing Menu

Uploading the XML File

Select Upload to Web Portal from the Web Portal Export/Filing Menu

Links

Link to 1095-C form (for reference ONLY): https://www.irs.gov/pub/irs-pdf/f1095c.pdf

Use this link to determine whether you must file 1095-C forms electronically https://www.irs.gov/Affordable-Care-Act/Employers/Information-Reporting-by-Applicable-Large-Employers

How it Works

After finalizing year end payroll data

- Select ACA 1094-C/1095-C Export from the Web Portal Export/Filing menu. These options automatically upload data to the 3rd Party Web Portal.

- From there you can setup an account (if needed)

- Finish processing following the online options.

- E-File services let you preview and adjust data before filing.

- When filing 1095s (and optionally W2s) you choose the option E-File as well as Print and Mail Services. Keystone does not print 1095 forms.

- With the Print and Mail services your 1095s are printed and mailed directly to employees. In addition an email is sent to each employee with an option to preview forms online.

- Verify that E-Filing has been accepted by the IRS. NOTE: 1095 filing is much more prone to rejection than W-2 filings. The most common issue is TIN (SSN) mismatches due to small errors with name spellings.

Remember it is your responsibility to verify taxes are accurately and completely filed and forms are received by employees!