Payroll: Employee File Maintenance

About

- Payroll

- File Maintenance

This applies to versions 2.9.14 and above. For earlier versions see: Archive: Payroll: Employee File Maintenance

Using the Program

Tabs

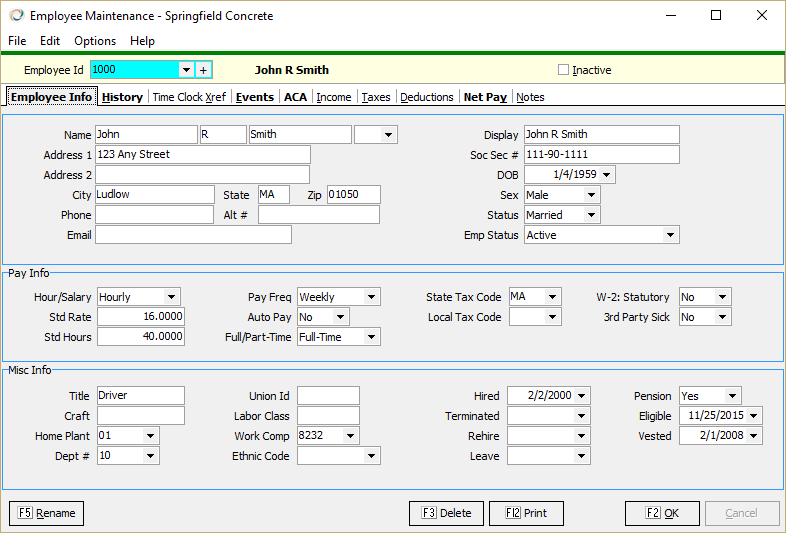

Employee Info

Key Fields

- Employee Status:

- Active

- Terminated

- Retired

- Deceased

- Disabled

- Long-term Disability

- Leave of Absense

- Miltary Leave

- Layoff

- Layoff Seasonal

Pay Info

This tab contains most of the fields used to determine pay rates, types etc.

- Hour/Salary:

- Std/Rate: For hourly this is the hourly rate. For salary this is pay per period.

- Std Hours: For Hourly this is used as the default number of hours for automatic pay. For Salary, this is used to determine the rate in time card entry (e.g. if Std Rate is 1000 and Std Hours is 40 then the rate will be 1000 / 40 = $25). For semi-monthly use 86.6667 and for montly use 173.3333)

- Pay-Frequency

- Auto Pay? Determines if employee gets included in Auto-Pay run.

- Full/Part-Time

- State Tax Code Default state to tax. Can be over ridden at time card level

- Local Tax Code Default locality to tax. Can be over ridden at time card level

- W-2 Statutory: Used for W-2

- 3rd Party Sick: Used for W-2

Misc

Enter additional employee information.

History

Shows MTD,QTD and YTD data for employee. Click the Show Data button.

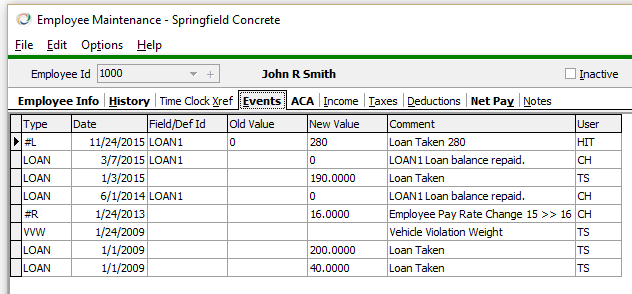

Events

The Events tab contains a grid showing both system created and manually entered events. For example, certain field changes will create a #F event showing the value before and after.

- Type is a code indicating the event type. Event types #L, #R and #F are system generated. The system comes with dozens of other predefined codes as well.

- Date

- Field/Def ID Automatically genarated events use this to specify the def or field affected.

- Old Value

- New Value

- Comment

- User Keystone User that created the event.

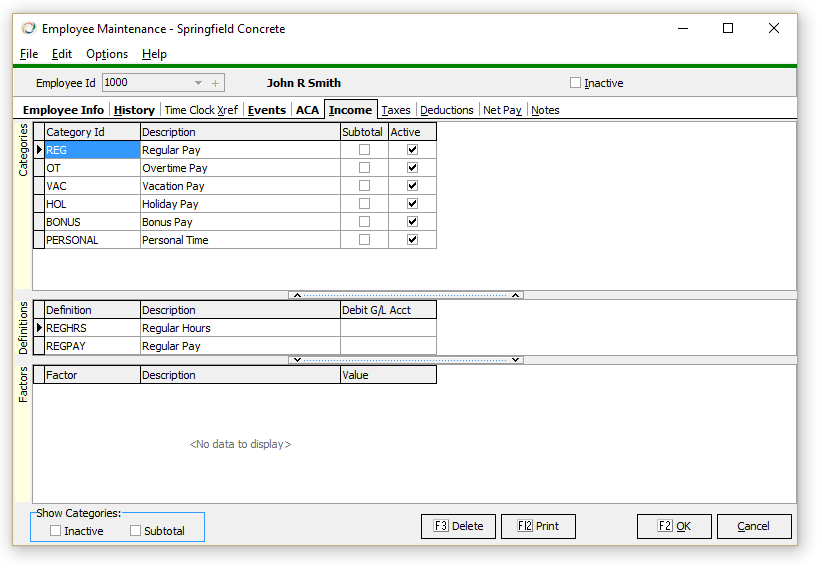

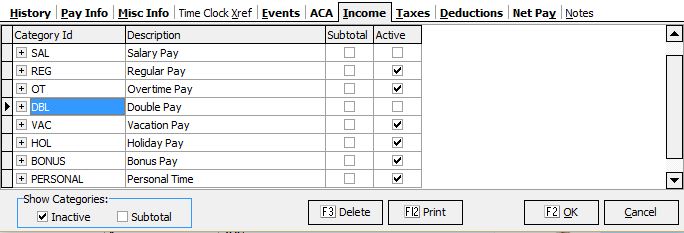

Income

- Activate all pay types appropriate for the employee

- Modify the G/L Debit account to override the default

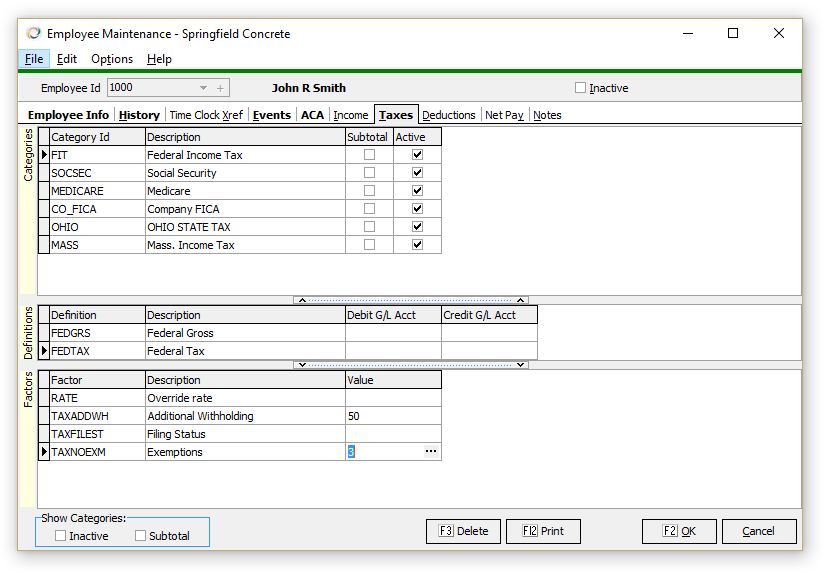

Taxes

- Activate Taxes

- Set Tax Factors

- Number of Exemptions - this field supersedes the marital status set on the employee. Enter 1 for single, 2 married, 3 head of household. Common use is to force withholding at the higher single rate for a married employee.

- Extra Witholding

- Override default G/L accounts (Only enter a G/L account if you do wish to use an account different than the default)

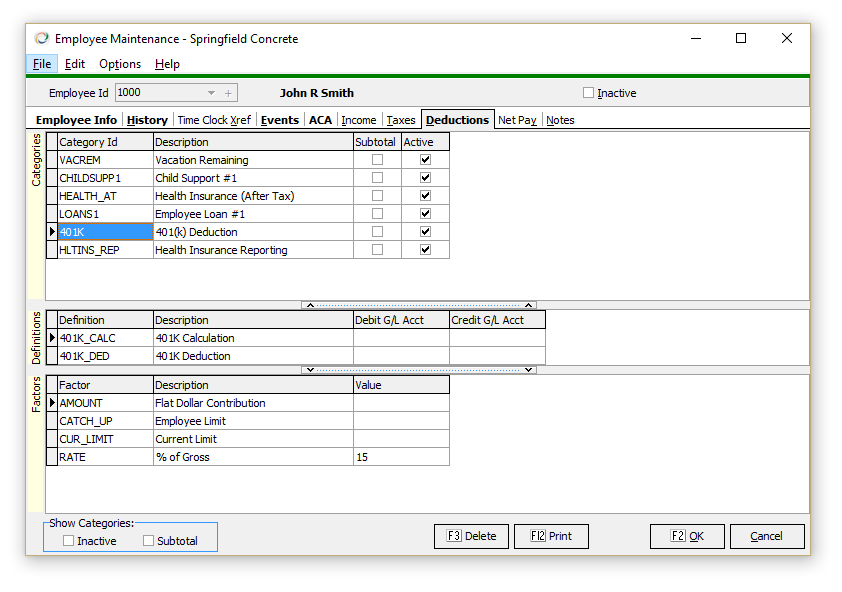

Deductions

- Activate Deductions

- Set appropriate Deduction Factors

- Deduction Amount

- Remaining Balance (Loan type deductions)

- Percentage

- Override default G/L accounts only when necessary. It is best to leave this blank in most cases.

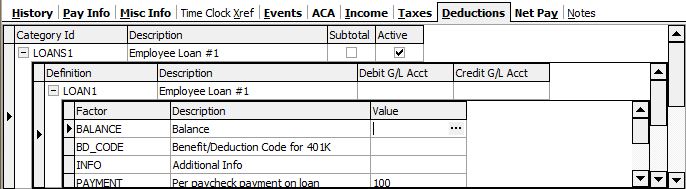

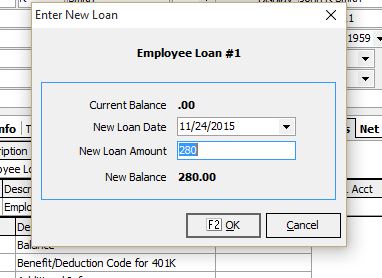

Setting up a loan

To update a loan balance, click the elipse (...) in the Balance field. For best results o this before Prepare Payroll for the current week.

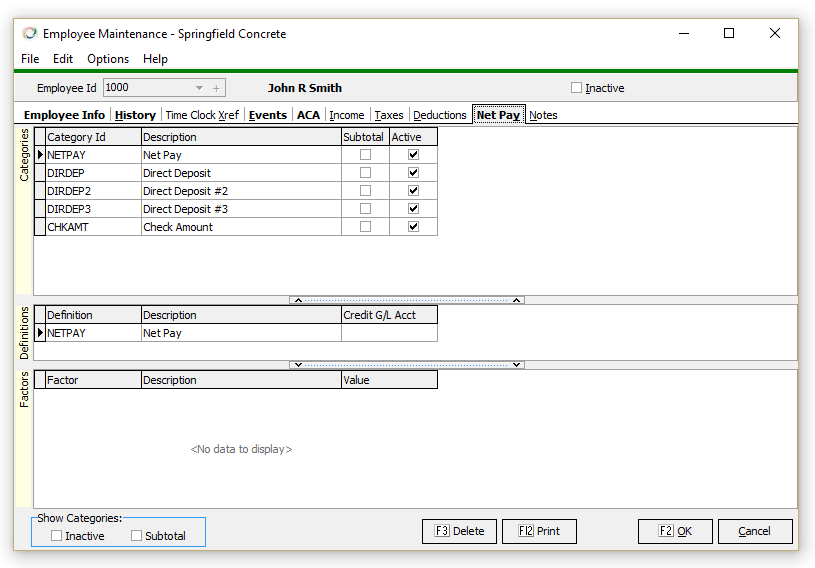

Net Pay

For systems without Direct Deposit, there should be no need to change the settings on Net Pay. Both the NETPAY and CHKAMT definitions should be active by default.

Setting up direct deposit:

Direct Deposit Setup

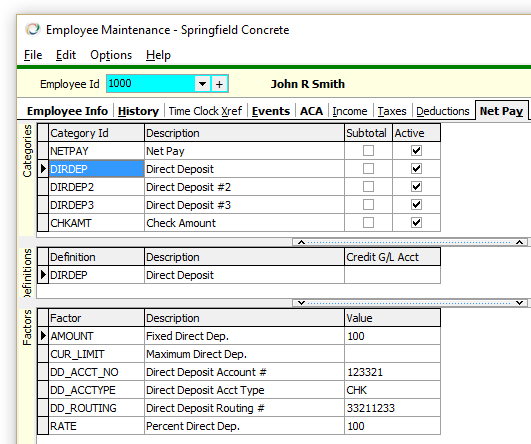

To configure a direct deposit, activate the definition and enter the factors.

- AMOUNT: Fixed Amount to deposit.

- CUR_LIMIT: Limit of deposit when using Rate

- DD_ACCT_NO

- DD_ACCTTYPE: CHK or SAV for Checking or Savings

- DD_ROUTING:

- RATE: Percentage of pay to withhold.

Use AMOUNT to withhold a specific amount (e.g. $100 per period). Use Rate to withhold a percentage of a Net Pay.

To simply withhold all of pay in a single Direct Deposit set RATE to 100.

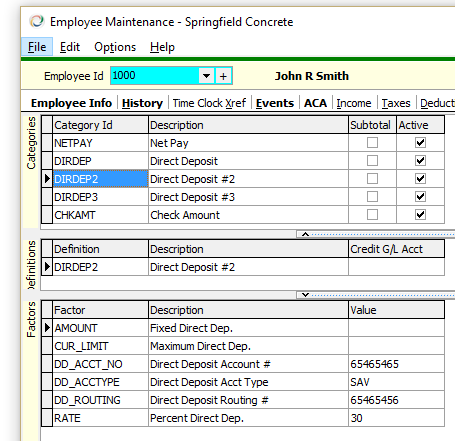

If you wanted to put $200 in an account and the rest into a second account then: Set Direct Deposit 1, AMOUNT to $200 Set Direct Deposit 2, RATE to 100 (100% will take whatever is left)

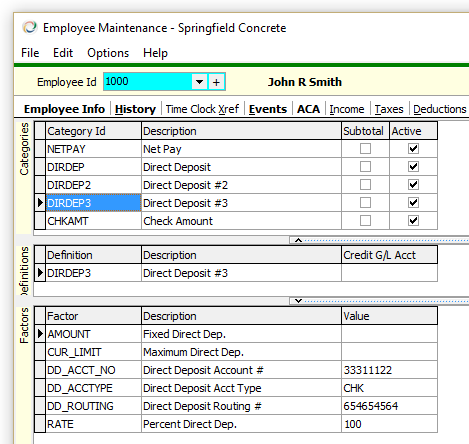

If you want to split money between 3 accounts at a 25%/40%/35% split: Set Direct Deposit 1, RATE to 25 Set Direct Deposit 2, RATE to 40 Set Direct Deposit 3, RATE to 100 (100% will take whatever is left)

If you want to deposit $200 and print the rest on a check: Set Direct Deposit 1, AMOUNT to $200

Whenever any amount left over after the direct deposit processing a check will be printed. In the examples above the practice of setting the RATE to 100 on the last direct deposit is to include all remaining money as a deposit. This prevents the chance that a rounding error will result in a $.01 check.

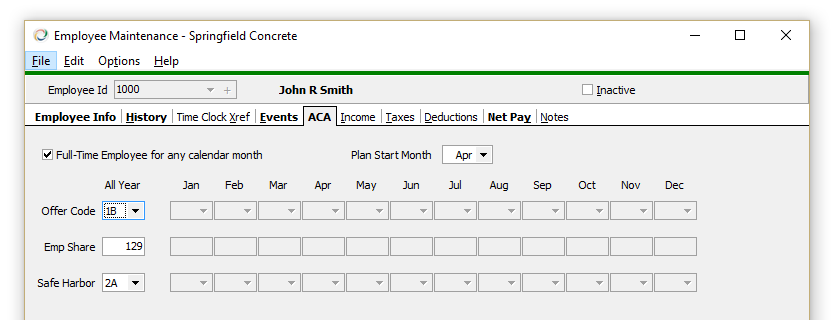

ACA

Used to enter data for 1095-C:

Enter either a value in the All Year box or into each monthly box. When a value is entered into the All Year box the monthly boxes become unavailable. Delete the all year box to regain access to the monthly boxes.

Tips and Tricks

- To set a tax as exempt for an employee, set the number of deductions to -1