Difference between revisions of "Payroll: Year End"

| Line 1: | Line 1: | ||

<span style="color:#FFFFFF; background:#FF0000; font-size:30">Preliminary Notes for 2019</span> | <span style="color:#FFFFFF; background:#FF0000; font-size:30">Preliminary Notes for 2019</span> | ||

| − | + | =Year End 2019= | |

*There are no changes to the printed W2 form for 2019. | *There are no changes to the printed W2 form for 2019. | ||

*There are no changes to the printed W3 form for 2019. | *There are no changes to the printed W3 form for 2019. | ||

| Line 9: | Line 9: | ||

*'''ACA''' Reporting: See [[Payroll: ACA Reporting]] to determine if you need to file 1094/1095. Typically any employer with greater than 50 employees. | *'''ACA''' Reporting: See [[Payroll: ACA Reporting]] to determine if you need to file 1094/1095. Typically any employer with greater than 50 employees. | ||

| − | + | ==Your W-2 Filing Options== | |

{|border="0" cellspacing="5" cellpadding="5" align="center" | {|border="0" cellspacing="5" cellpadding="5" align="center" | ||

| Line 15: | Line 15: | ||

Any Employer with fewer than 250 employees can print both employee copies and government copies from Keystone. Distribute W2s to employees. Mail government copies to appropriate agencies. | Any Employer with fewer than 250 employees can print both employee copies and government copies from Keystone. Distribute W2s to employees. Mail government copies to appropriate agencies. | ||

|'''Keystone E-File''' | |'''Keystone E-File''' | ||

| − | Use Keystone to Print W-2s for employees and to generate files for government filing. Distribute W2s to employees. Verify E-File integrity with Accuwage and then upload files to government websites. This option requires proper registration with government agencies (i.e. the IRS/SSA). | + | Use Keystone to Print W-2s for employees and to generate files for government filing. Distribute W2s to employees. Verify E-File integrity with Accuwage and then upload files to government websites. This option requires proper registration with government agencies (i.e. the IRS/SSA). <b>Only the following states are supported by this option: AL,CO,CT,GA,IA,IL,IN,KS,KY,LA,MA,MI,MN,MO,MS,MT,NE,OH,OK,OR,PA,RI,SC,VA,WI.</b> |

|'''Web Services E-File''' | |'''Web Services E-File''' | ||

With this premium service use Keystone to prepare and upload data to our online service. For a small per-employee fee have all W-2s printed and mailed to employees and E-Filed to government agencies. See: '''[[W-2 Filing Web Service]]'''. | With this premium service use Keystone to prepare and upload data to our online service. For a small per-employee fee have all W-2s printed and mailed to employees and E-Filed to government agencies. See: '''[[W-2 Filing Web Service]]'''. | ||

*No need to purchase and print mail W-2s | *No need to purchase and print mail W-2s | ||

*Employees receive printed W-2s and emailed W-2s with the ability to re-print | *Employees receive printed W-2s and emailed W-2s with the ability to re-print | ||

| + | *<b>This option supports all states.</b> | ||

|} | |} | ||

| + | <!-- | ||

====2019 W2 E-File==== | ====2019 W2 E-File==== | ||

*The following states are supported by the W-2 E-File Export option: AL,CO,CT,GA,IA,IL,IN,KS,KY,LA,MA,MI,MN,MO,MS,MT,NE,OH,OK,OR,PA,RI,SC,VA,WI. | *The following states are supported by the W-2 E-File Export option: AL,CO,CT,GA,IA,IL,IN,KS,KY,LA,MA,MI,MN,MO,MS,MT,NE,OH,OK,OR,PA,RI,SC,VA,WI. | ||

*If you need to electronically file W-2s for a state not listed above, you must use the Federal & State W-2 Export option on the Web Portal Export/Filing menu. (This is a premium service that involves a per-employee fee.) | *If you need to electronically file W-2s for a state not listed above, you must use the Federal & State W-2 Export option on the Web Portal Export/Filing menu. (This is a premium service that involves a per-employee fee.) | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

--> | --> | ||

| − | ==Notes for 2019 Year End | + | ==Notes for 2019 Year End== |

| − | |||

| − | |||

| − | |||

| − | |||

*Two programs we recommend to enhance year end maintenance: | *Two programs we recommend to enhance year end maintenance: | ||

| Line 48: | Line 41: | ||

Also see: '''[[Payroll: Health Insurance|Health Insurance]]''' | Also see: '''[[Payroll: Health Insurance|Health Insurance]]''' | ||

| − | =Year End Procedures= | + | ==Year End Procedures== |

| − | ==Before Running the first Payroll of the new Year== | + | ===Before Running the first Payroll of the new Year=== |

*Make a backup to file and save in a permanent location. see [[Keystone Database Backup]] | *Make a backup to file and save in a permanent location. see [[Keystone Database Backup]] | ||

*[[Web Update]] to the latest Keystone version. | *[[Web Update]] to the latest Keystone version. | ||

| Line 57: | Line 50: | ||

*Set up Payroll Periods for 2020. see [[Setup Periods]] | *Set up Payroll Periods for 2020. see [[Setup Periods]] | ||

| − | ===Set Up Retirement Plan Limits=== | + | ====Set Up Retirement Plan Limits==== |

*Run [[Payroll Adjust Company Definitions & Factors|Adjust Company Definitions & Factors]] from the payroll Setup/Utilities Menu | *Run [[Payroll Adjust Company Definitions & Factors|Adjust Company Definitions & Factors]] from the payroll Setup/Utilities Menu | ||

*Select the correct Link for the retirement plan. | *Select the correct Link for the retirement plan. | ||

| Line 76: | Line 69: | ||

--> | --> | ||

| − | ===Set Up Suta Rates & Limits=== | + | ====Set Up Suta Rates & Limits==== |

'''Note:''' Not all Keystone Payroll systems are configured to calculate Suta & Futa during the payroll process. | '''Note:''' Not all Keystone Payroll systems are configured to calculate Suta & Futa during the payroll process. | ||

*Run [[Payroll Adjust Company Definitions & Factors|Adjust Company Definitions & Factors]] from the Payroll Setup/Utilities Menu | *Run [[Payroll Adjust Company Definitions & Factors|Adjust Company Definitions & Factors]] from the Payroll Setup/Utilities Menu | ||

| Line 108: | Line 101: | ||

==Processing ACA Forms (1094/1095)== | ==Processing ACA Forms (1094/1095)== | ||

If required continue on to [[Payroll: ACA Reporting]] | If required continue on to [[Payroll: ACA Reporting]] | ||

| + | |||

| + | =Tax Year 2020= | ||

| + | *Keystone 3.6.4 has been updated with new 2020 FEDERAL income tax rates and social security and medicare income thresholds. | ||

| + | <!-- | ||

| + | *The following state income tax rates have been updated: NY, OH. | ||

| + | --> | ||

| + | *Federal and many State Tax Rates have changed for 2020. Tax Tables have been updated to reflect these changes. We recommend that you check this site several times during the year for the latest information!!!! | ||

| + | |||

| + | *To assist with state specific tax information, please consult the following link: http://www.payroll-taxes.com/state-tax.htm <br>(NOTE: GivenHansco is not responsible for the information provided on this site, we are providing this as a self-help service for our customers.) | ||

| + | |||

| + | ==New W-4 Form for 2020== | ||

| + | <i>Keystone will support the new 2020 W-4 information in a future release. Please check this page periodically for updates.</i> | ||

| + | |||

| + | For 2020 the IRS has created a new W-4 form which impacts calculation of federal taxes in Keystone Payroll. | ||

| + | |||

| + | In a forthcoming release of Keystone, we will automatically add new employee factors to the Federal Tax definition of every employee. | ||

| + | |||

| + | Below is a description of these new factors and how they relate to the new 2020 W-4 form. Note that these factors are only used with the 2020 W-4 Form: | ||

| + | |||

| + | {| class="wikitable" | ||

| + | |- | ||

| + | ! Keystone Factor Id | ||

| + | ! 2020 W-4 Form | ||

| + | ! Comment | ||

| + | |- | ||

| + | | W4YEAR | ||

| + | | | ||

| + | | Enter <b>2020</b> when using the new 2020 W-4 form, blank otherwise | ||

| + | |- | ||

| + | | TAXFILEST | ||

| + | | Step 1(c) | ||

| + | | Enter:<BR><b>1</b> for Single<BR><b>2</b> for Married filing Jointly<BR><b>3</b> for Married filing Separately<BR><b>5</b> for Head of Household<BR><b>6</b> for Qualifying Widower | ||

| + | |- | ||

| + | | W4TWOJOBS | ||

| + | | Step 2(c) | ||

| + | | Enter <b>Y</b> if the box is checked, blank otherwise | ||

| + | |- | ||

| + | | W4DEPEND | ||

| + | | Step 3 Line 3 | ||

| + | | Enter the amount (this is an <b>annual</b> amount) | ||

| + | |- | ||

| + | | W4OTHINC | ||

| + | | Step 4 Line 4(a) | ||

| + | | Enter the amount (this is an <b>annual</b> amount) | ||

| + | |- | ||

| + | | W4DEDUCT | ||

| + | | Step 4 Line 4(b) | ||

| + | | Enter the amount (this is an <b>annual</b> amount) | ||

| + | |- | ||

| + | | TAXADDWH | ||

| + | | Step 4 Line 4(c) | ||

| + | | Enter the amount (this is a <b>per pay period</b> amount) | ||

| + | |} | ||

Revision as of 01:36, 9 January 2020

Preliminary Notes for 2019

Contents

Year End 2019

- There are no changes to the printed W2 form for 2019.

- There are no changes to the printed W3 form for 2019.

- Keystone 3.6.4 has been updated with 2019 changes for e-filing W-2s.

- January 31, 2020 is the deadline for E-File and Printed W-2s.

- SSA.GOV W-2 information for 2019: https://www.ssa.gov/employer/

- ACA Reporting: See Payroll: ACA Reporting to determine if you need to file 1094/1095. Typically any employer with greater than 50 employees.

Your W-2 Filing Options

| Paper W-2

Any Employer with fewer than 250 employees can print both employee copies and government copies from Keystone. Distribute W2s to employees. Mail government copies to appropriate agencies. |

Keystone E-File

Use Keystone to Print W-2s for employees and to generate files for government filing. Distribute W2s to employees. Verify E-File integrity with Accuwage and then upload files to government websites. This option requires proper registration with government agencies (i.e. the IRS/SSA). Only the following states are supported by this option: AL,CO,CT,GA,IA,IL,IN,KS,KY,LA,MA,MI,MN,MO,MS,MT,NE,OH,OK,OR,PA,RI,SC,VA,WI. |

Web Services E-File

With this premium service use Keystone to prepare and upload data to our online service. For a small per-employee fee have all W-2s printed and mailed to employees and E-Filed to government agencies. See: W-2 Filing Web Service.

|

Notes for 2019 Year End

- Two programs we recommend to enhance year end maintenance:

- Employers with more than 250 employees will need to report health insurance costs paid by the company to each employee.

- Keystone has the ability to track these health insurance costs. Keystone payroll users have 2 options:

- Follow the special procedures in Keystone to track employer paid health insurance. See Payroll: Year End Modifications

- Calculate and manually enter employer paid health insurance at the end of 2014. Using the new program Adjust Definition Balances makes this much easier.

- Keystone has the ability to track these health insurance costs. Keystone payroll users have 2 options:

Also see: Health Insurance

Year End Procedures

Before Running the first Payroll of the new Year

- Make a backup to file and save in a permanent location. see Keystone Database Backup

- Web Update to the latest Keystone version.

- Review Health Insurance and determine if you need to run Year End Modifications to configure health insurance reporting information for 2019.

- Set up Payroll Periods for 2020. see Setup Periods

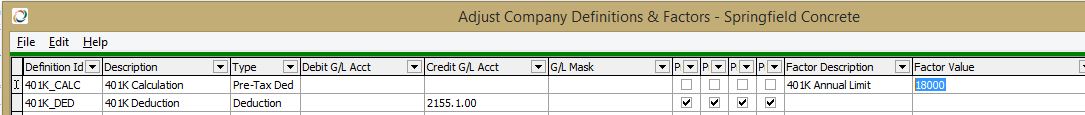

Set Up Retirement Plan Limits

- Run Adjust Company Definitions & Factors from the payroll Setup/Utilities Menu

- Select the correct Link for the retirement plan.

- Stretch the width of the screen or scroll to the right until you see the factor name for annual limit

- Update the annual limit amount.

- NOTE: Check for changes to retirement plans for 2020

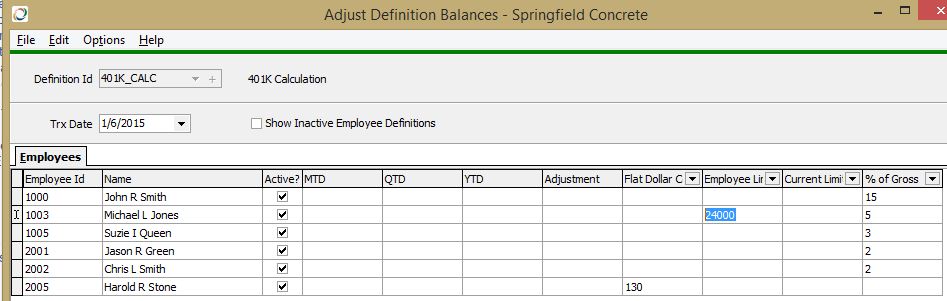

For Employees who qualify for the higher catch up limit:

- Run Adjust Definition Balances From the Payroll Setup/Utilities menu.

- Widen the screen or scroll to the right and find the Limit factor.

- Set the higher limit amount. Leave Blank for all other employees.

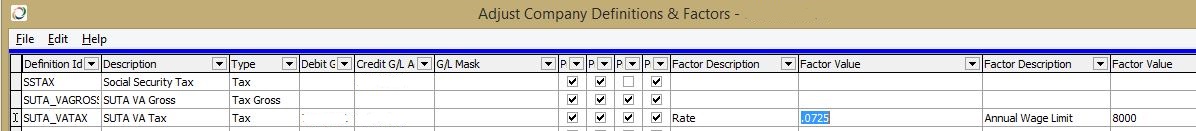

Set Up Suta Rates & Limits

Note: Not all Keystone Payroll systems are configured to calculate Suta & Futa during the payroll process.

- Run Adjust Company Definitions & Factors from the Payroll Setup/Utilities Menu

- Select the correct Link for the Suta Calculation

- Stretch the width of the screen or scroll to the right until you see the factor name for annual limit and rate.

- Update the limit and rate amounts.

Processing W2s

- Determine if Health Insurance needs to be reported. See: Health Insurance

- Verify all year end balances are correct for 2019

- Update W2 Setup

- Make sure to update this for health insurance reporting if required

- Make sure all States are complete with up to date E.I.N. codes

- Print W-2 Audit list by using Print W2s and selecting Audit List.

- If you choose the new premium services finish filing with W-2_Filing_Web_Service. Otherwise continue...

- Print W2s

- Verify W2 Values

- W2 E-File Export

- Verify with Accuwage http://www.socialsecurity.gov/employer/accuwage/index.html

- NOTE: Accuwage is designed to verify the Federal W2 E-File. Though it may work for some states, in general it should only be used to validate the Federal file. For some states, it may report errors where there are none.

- Print W3s

- Verify W3s with company totals

NOTE: Payroll may be run in the new year before the prior year W2s are printed. Payroll runs in the new year will not affect prior year W2s.

Frequently check Keystone Help and this page for any updates

GivenHansco strongly recommends that you manually verify the numbers reported on W2/W3 forms and use the SSA AccuWage program to verify the numbers on W2 E-File Export. By submitting W2/W3 forms and W2 E-File Export data to the IRS, you are legally testifying to the accuracy of the data.

Processing ACA Forms (1094/1095)

If required continue on to Payroll: ACA Reporting

Tax Year 2020

- Keystone 3.6.4 has been updated with new 2020 FEDERAL income tax rates and social security and medicare income thresholds.

- Federal and many State Tax Rates have changed for 2020. Tax Tables have been updated to reflect these changes. We recommend that you check this site several times during the year for the latest information!!!!

- To assist with state specific tax information, please consult the following link: http://www.payroll-taxes.com/state-tax.htm

(NOTE: GivenHansco is not responsible for the information provided on this site, we are providing this as a self-help service for our customers.)

New W-4 Form for 2020

Keystone will support the new 2020 W-4 information in a future release. Please check this page periodically for updates.

For 2020 the IRS has created a new W-4 form which impacts calculation of federal taxes in Keystone Payroll.

In a forthcoming release of Keystone, we will automatically add new employee factors to the Federal Tax definition of every employee.

Below is a description of these new factors and how they relate to the new 2020 W-4 form. Note that these factors are only used with the 2020 W-4 Form:

| Keystone Factor Id | 2020 W-4 Form | Comment |

|---|---|---|

| W4YEAR | Enter 2020 when using the new 2020 W-4 form, blank otherwise | |

| TAXFILEST | Step 1(c) | Enter: 1 for Single 2 for Married filing Jointly 3 for Married filing Separately 5 for Head of Household 6 for Qualifying Widower |

| W4TWOJOBS | Step 2(c) | Enter Y if the box is checked, blank otherwise |

| W4DEPEND | Step 3 Line 3 | Enter the amount (this is an annual amount) |

| W4OTHINC | Step 4 Line 4(a) | Enter the amount (this is an annual amount) |

| W4DEDUCT | Step 4 Line 4(b) | Enter the amount (this is an annual amount) |

| TAXADDWH | Step 4 Line 4(c) | Enter the amount (this is a per pay period amount) |